FTX's Liquidity Crunch: A Wake-Up Call for Regulation

Written in December 2022

Abstract: The essay examines the collapse of FTX, attributing it to improper financial practices and regulatory inconsistencies as key factors. More regulatory efforts should aim to create a more secure cryptocurrency industry. The essay points out several regulatory policies such as the Digital Commodity Consumer Protection Act (DCCPA) and Digital Currency Governance Consortium as promising initiatives to standardize definitions and promote consistent regulation in the digital asset market.

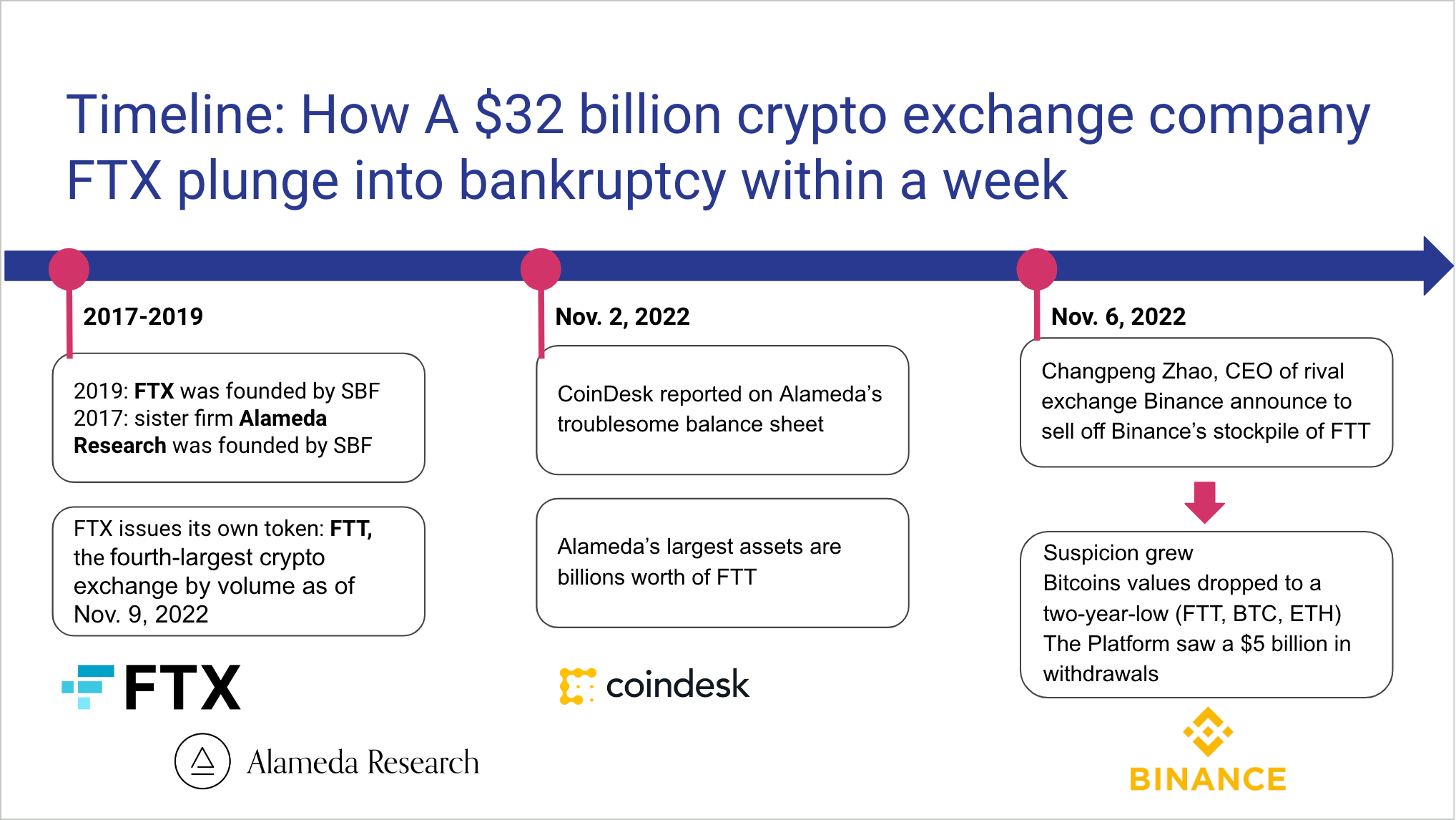

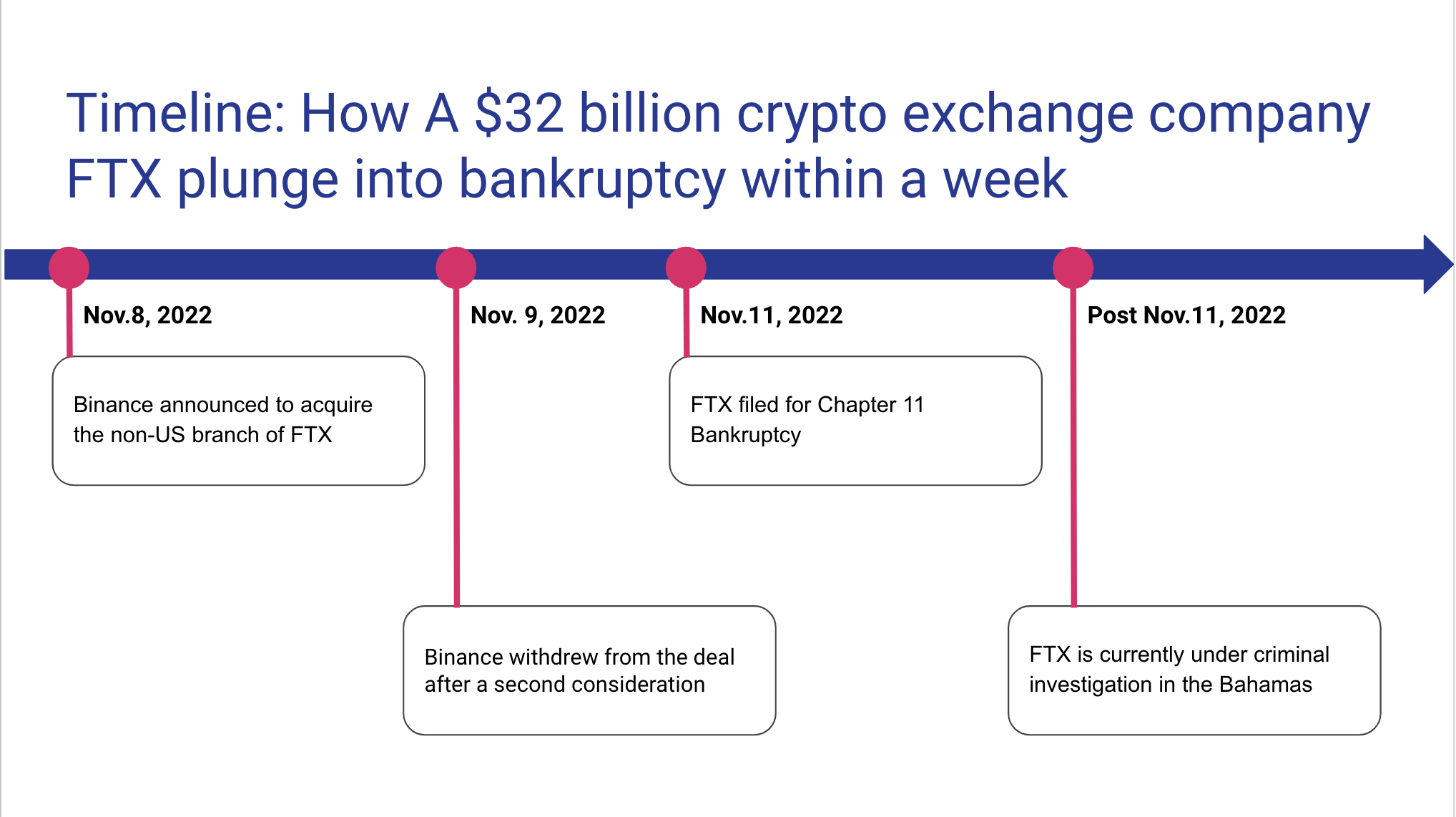

Being both the reason and the result of FTX’s collapse, liquidity crunch is further exacerbated by a cascade of withdrawal of deposits and sell-off of FTT. This is led by FTX’s viral company Binance’s CEO Changpeng Zhao. In fear of Alameda’s inability to pay back and further reduce in FTT value, CZ sold off Binance’s FTT holdings worth $2.1 billion to avoid any potential loss. This serves as a significant signal to individual investors, other hedge funds and venture capitalists. People start liquidating from FTX because the FTT doesn't mean much as a collateral. As all investors followed, the price of the FTT token nosedived 75% in a day, making the collateral insufficient to cover the trade. The result, as we all know, is the market value evaporation of FTX. In short, the improper trading between Alameda and FTX led to the liquidity crisis, which turned into the liquidity crunch accelerated by a cascade of withdrawals.

The liquidity crunch FTX faced was also due to the inconsistent regulation on the digital currency sector in the U.S. The risks associated with the crypto market stem from the multiplicity of regulators and the ambiguity in their responsibilities. Firstly, the U.S. crypto regulation involves many agencies including not only the SEC and the CFTC but also the Financial Crimes Network of the Department of the Treasury and the states. “Money transmitting businesses” must register with the U.S. Secretary of the Treasury. The individual states also administer money transmitters through their respective Blue Sky Laws. For example, the New York state requires crypto businesses to apply for a licence from the New York Department of Financial Services (NYDFS) and comply with disclosure and examination requirements.(Alkadri, 2019) The multiplicity of regulators and rules creates obstacles to transparency and federal regulation.

The confusion within the regulatory space is further complicated by debates around crytocurrency’s nature. There have been intensive debates on whether digital assets should be classified as securities and therefore regulated by the Securities and Exchange Commission (SEC), or commodities and therefore regulated by Commodity Futures Trading Commission (CFTC). If cryptocurrency is considered as securities, the crypto companies must comply with the SEC rules for reporting and registration. The SEC is the traditional federal regulatory regime governing the exchanges of securities such as equities, debt, and investment contracts, as the Securities Act of 1933 and the Securities Exchange Act of 1934 set up rigorous reporting, record-keeping, and disclosure requirements for securities exchanges. However, if cryptocurrency is considered as commodities, they would fall under the regulation of the CFTC. In contrast to the SEC, the CFTC has regulatory authority over derivatives such as swaps, futures, and options. The CFTC also regulates “fraud and manipulation” in the commodities market.

Thus, the division of power and responsibility among the regulators, most notably the SEC and the CFTC, has been unclear. The SEC Chair Gensler continues to stress SEC’s central role in regulating crypto in a recent speech in 2021: “These products are subject to the securities laws and must work within our securities regime.”(SEC, 2021) The SEC has been active in enforcement actions, most famously the ones against Ripple in 2020 and against BlockFi in 2022. However, the CFTC has determined that cryptos are commodities, with the chair Heath Tarbert declaring in 2019 that: “it is my view as Chairman of the CFTC that Ether is a commodity.”(CFTC, 2019) The Lummis-Gillibrand Responsible Financial Innovation Act proposed in June 2022 expanded the scope of the CFTC’s regulatory authority by granting it exclusive jurisdiction over digital assets, excluding the assets that provide financial interests, which belong to SEC’s jurisdiction.(Ropes& Gray, 2022) After the FTX collapse, the CFTC Chairman Berham urged the congress to give the agency more authority in regulating digital assets and pushed for the passing of The Digital Commodity Consumer Protection Act (DCCPA).(WSJ 2022) As the newer and smaller financial regulator, however, the moves of the CFTC are seen by some as “a transparent jurisdiction-expanding power grab.”

The inconsistent regulation on the crypto market in the U.S. partly caused the regulators’ overlook on FTX. FTX is licensed by and registered with the CFTC. Since the CFTC has fraud and manipulation enforcement authority, many criticize it for missing FTX’s improper conducts such as commingling of funds and close relationship with Alameda.(Thiruchelvam, 2022) However, the CFTC Chairman claimed that “Unlike other federal financial regulators, the CFTC lacks the necessary and direct authority to write rules and to oversee this marketplace. Instead, we may only reach it through more limited authority activated when fraud or manipulation has already occurred.”(CFTC 2022) The lack of clear division of regulatory power resulted in FTX’s illegal conducts and the liquidity crunch that followed the public panic at its failure.

Looking to the future, we can see that there are huge spaces in the regulations to improve. There are two major areas to take action on, including closer monitoring of crypto assets and better crypto risk assessments. To have closer monitoring of crypto assets, there should be real-time crypto exchange assets monitoring, instead of using the annual reports that would easily involve large inaccuracies. Also, independent audit reports from an independent third party are valued to provide an objective perspective and review of the balance sheet of exchange, making it possible to track the flows of money in and out of investors’ wallets. Another aspect of improvement and direction for the future crypto market is to enhance crypto risk assessments, including conducting stress-testing of data involved in the blockchain of crypto transactions, restricting the use of an exchange’s token to make loans to crypto firms, just as the reason behind today’s FTX collapse. More protection for customers is needed to prevent exchanges from suspending withdrawals. (Ganesh, 2022)

One of the most significant policies introduced recently to enhance the regulations of the crypto market is the Digital Commodity Consumer Protection Act (DCCPA), which was officially introduced to the US Congress on August, 3rd, 2022. It has already got bipartisan support and is still waiting for agreements from the US. Senate, House of Representatives, and President Joe Biden to become an official law. DCCPA attributes the responsibility of regulating crypto assets to CFTC, extending the power of the authority while preventing situations that the collapse of a crypto company is considered out of accountability by both SEC and CFTC, like what happened in FTX’s collapse. (Lindrea, 2022) DCCPA clearly proposes actions to do for two different sectors: the crypto commodity platforms, including brokers, dealers, custodians, and exchanges, and requirements for the CFTC. (Ligon, 2022) The FTX’s collapse seems to accelerate the enforcement of greater federal oversight over the digital asset industries.

Regarding today’s crypto market, two imperative and fundamental problems remain: one is the absence of common standards and terminologies, and the other one is the inconsistent regulations across the globe. To solve these two problems, another bill is introduced, the Lummis-Gillibrand Bill, which creates clearer definitions by giving out exact and accurate definitions of commodities and equities. (Kirsten Gillibrand, 2022) Moreover, the Digital Currency Governance Consortium is established by the World Economic Forum to enable people and organizations from more than 80 organizations around the world to discuss consistent regulating and operating approaches for the digital asset market and leveraging best practices through broad and diverse perspectives brought by the representatives of various sectors and geographies. (White, 2022) In a word, there is still a long way to go to regulate the digital market currency well, while new policies and regulations need to be updated and further research on the digital assets market and macroeconomic influences are yet to be conducted.

In conclusion, it’s argued that the collapse of FTX stems not only from the improper trading practices between FTX and its sister company as well as the fuel from its rival Binance, but also from the structural issue within the U.S. crypto regulation. While many condemn the improper conduct of SBF, who transferred customers’ funds for other uses, the problems with the lack of clear regulatory rules for the crypto market is especially worth noting. The FTX collapse is a lesson for the U.S. policymakers to strengthen the federal oversight on the crypto market. Only with a strong federal regulatory agency who is empowered to require reporting of market information and have anti-fraud enforcement authority in the entire crypto market, we would be able to control risks in this market. The cryptocurrency market is still young and vibrant, and we are hoping to see it become more mature.

In less than a week, the cryptocurrency billionaire Sam Bankman-Fried (SBF) went from industry leader to villain. He saw his $32 billion crypto exchange company FTX plunge into bankruptcy and became the target of investigations by the SEC. This dramatic collapse of FTX has caused extreme ripple effects, not only victimizing investors and significant venture capitalists but also catching Capital Hill’s financial regulators’ attention.

In light of this most significant liquidity crunch in the short history of cryptocurrency, this essay intends to review and analyse the reasons behind the FTX fall and how different parties including SBF’s trading company Alameda and Changpeng Zhao’s Binance played their roles fueling the collapse. We will start with the fundamental cause of the fall which seems to be SBF’s improper use of investors’ funds to his other trading company Alameda. Next, we will discuss FTX’s liquidity issue which contributes to a cascade of events including Zhao and investors’ sudden exits and selloff in FTT tokens. The third reason would be the lack of regulation towards the crypto industry. Finally, we want to examine the increasing appeal to DeFi regulations as reflected by the Digital Commodities Consumer Protection Act and other potential contradicting voices toward future regulation policies.

The first and foremost cause of the collapse was Alameda's improper trading with FTX and misuse of customers’ deposits. Alameda Research and FTX are two sister companies both founded by SBF. Alameda Research started off as a small trading firm, whose business model depends on leveraging cheaper Bitcoin and other cryptocurrencies and reselling them at a higher price to pocket the difference. As the need for funds for Alameda grew, SBF founded the cryptocurrency exchange platform FTX. While FTX nominates FTT as its main crypto token for transactions, Alameda served as the token’s market maker, enabling large amounts of buying and selling of FTT and thereby creating a higher market value of FTT (Allison, 2022). Alameda continued to use its holdings of FTT as collateral for more loans to facilitate its trading activities. For investors, trading on FTX and Alameda also sounds appealing because of the trading discounts it offers. While still illegal, such exercise wouldn’t catch the public's immediate attention as long as Alameda has enough money to pay back its investors, and if FTT can keep its high value as the collateral. However, it would become an issue if these two conditions broke. And that is indeed what happened. On November 2nd, Coindesk, a news site specialising in bitcoin and digital currencies, disclosed three disturbing facts that significantly shaken investors’ trust in the company. Firstly, FTX’s biggest customer is actually Alameda. Secondly, Alameda has accumulated a large “margin position” on FTX, which means Alameda has borrowed a large amount of funds from the exchange. And lastly, the amount mounted to be $3.2 billion worth of assets locked in FTX’s token FTT (Jafar, 2022). Instead of holding any money, Alameda was borrowing billions from FTX users, and had barely enough money to pay back investors. In short, the blurred lines between FTX and Alameda is the fundamental reason for the liquidity crunch for both companies. And it is the liquidity crunch that resulted in the massive distrust in FTX that led to the next step in the collapse: massive withdrawal.

Post a comment